Regardless of the size, function, and revenue levels, every business must pay taxes to the government as part of patriotic duty and compliance with the national laws. However, these businesses go through significant challenges as they have to face the stress of filing their taxes since the owners might not have advanced knowledge of business tax filing.

For businesses with no clear systems and organizational structures, including the availability of documents needed to file for taxes effectively, the tax season can be stressful.

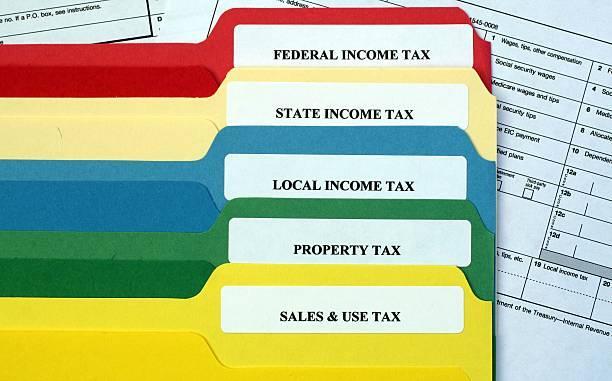

These challenges can either lead to businesses paying less or more taxes, which is a disadvantage. To ensure proper planning and to avoid tax stresses, businesses can rely on tools such as tax returns folders for organization purposes.

Just like the name, it is a storage, organization, and planning folder or system that helps alleviate the burden of tax season. Here are some reasons why you must have a tax return folder for your business.

- Organizing the Relevant Documents

When filing taxes, you need all the relevant documents like financial statements, charity receipts, credit statements, asset statements, and other relevant paperwork. These documents are essential for tax claims, justifying payment or failure to pay some taxes. I

Since small businesses do not have clear business systems, they are likely to deal with a lot of paperwork, hence the need for a proper organization system for tax-related documents. Therefore, such businesses should have different tax returns folders that enable them to sort out and store copies of original documents needed for tax filing.

Another reason to have them is to ensure past documents and records are properly organized, which is necessary to justify a decline in tax payments without raising suspicion.

- Information and Document Security

You should keep all your tax information secure and stored away from public access, hence the need for these folders to safely hide all the details.

With the tax return folder, you can hardly lose any document unless someone tries to steal the folder, which is rare. These folders are beneficial to prevent fraud and identity theft.

Even past documents should be kept discreetly and safely since you never know when you may need them for other reasons.

- Accurate Tax Filing

If you are going to file your taxes, you should ensure the details are accurate to avoid the consequences of inaccuracies. You should enter the correct values and accounts in order to prevent any mishappenings.

That is why you require a tax return folder to keep your documents safe so that they can be used at the time of need. The folder ensures that all the critical documents are kept firmly in one place without the risk of losing or mixing them with other documents or papers.

If you enter the wrong values, the consequences can include seeking a tax refund, which is time-consuming and expensive as you must visit tax offices. If you file fewer taxes due to wrong values, you will likely face tax penalties for lying in tax details and robbing the government.

Hence, while filing taxes, ensure to keep the tax returns folders in hand to enter the accurate details.

- Storing all the Documents

There are multiple documents you require for filing your taxes, especially receipts for various activities such as charity, training, and other expenditures, which can affect your taxation levels. Therefore, you should have the tax return folder to store the relevant papers at the beginning of the year to ensure by the time your tax experts are filing, they have all the documents ready.

Once you have filed the taxes, don’t get rid of the paperwork. Keep these documents organized and in a safe place. You should try to store the tax documents of the last five years. This is a lot of paperwork that could easily get lost somewhere. Therefore, the best option is to organize them in tax return folders.

- Peace of Mind

With everything safely kept, organized, and accounted for, you can have some relief that the tax season will not be stressful as you can easily share the right documents with your tax experts. With these documents, you can also file the taxes alone without needing expert help since all the documents are accounted for, and you do not need special counsel.

In the case of tax refunds, you have all the documents to challenge the tax authorities, and you can go through the process quickly. If the authorities sue you or summon you for tax crime issues or penalties, you can easily justify the values without much stress or hiring more lawyers and experts to help you with the filing.

Conclusion

If you must plan for the upcoming tax stress, you should stay ahead by having a tax return folder to keep all documents in order.

You need the folders for security reasons, tax accuracy, peace of mind, organization, and proper storage. With the right folders, you can hardly worry about penalties or the stress of following up on refunds.

Remember the above benefits while purchasing a tax returns folder, and ensure you buy a quality folder from a trusted manufacturer.